Contents

Disclaimer: I don’t offer crypto funds recovery, I can only help you avoid honeypots and crypto scams, which can lead to significant money loss.

- Out of the blue, you get a message that a crypto pFortfolio is found with your legal name containing a considerable amount of funds i.e. 20-200K, and you need to take a few steps to unlock it including creating an account and getting verified.

- You have lost money in a forex/trading scam and a “company” offers their help to recover your money.

- You file a complaint after a scam and your message gets intercepted by a sinister actor.

- An individual who provides services to you asks you to pay in crypto.

- An individual sends you a message on Whatsapp, Telegram, or Messenger, that he’s going to do a crypto pump in the next few days with a shitcoin (pardon my French) and you should invest to double your money.

- You buy a course where they promise you astronomical traffic to your website or a deep dive into trading.

All those cases above could be Tier 1 or Tier 2 scams. How do you protect yourself and your family against falling victim?

You need advanced technical skills to run forensic analysis on their messages and find the senders, IPs, locations, and intentions.

You need extensive crypto experience to protect yourself from social engineering and complex scams.

For a small fee of $70 (one hour of work), I could audit the messages, offers, and phone transcripts, check the phone numbers, and sales pages/websites and help you figure out whether there’s a scam ahead and who are the actors/perpetrators. This way you will have a clear picture that makes sense and protect your hard-earned savings.

If you know their websites and ads I’ll be more than happy to take action to take them down to avoid them scamming more people. Sometimes it works as they see they can’t be in business anymore and it makes sense to refund you to avoid way bigger losses by losing all the properties they have spent time and thousands in developing, hosting and advertising costs. On average I’m taking down 4 websites and other properties per week.

Efficiency of this service so far.

- One Mothership Scammer Website with more than 2.5K per month was taken down

- Two scam apps each with 1K users each were taken down from the Google Play store

- Numerous fraud ads from Social Networks

- Numerous scam/false information posts on Facebook

Are You Ready to Investigate the Scam?

Image by Freepik

Bitcoin Recovery

Before we delve into the inquiry of whether Bitcoin Recovery is attainable, let’s initially grasp its essence. Bitcoin Recovery commonly pertains to services or firms asserting to aid individuals in reclaiming lost or stolen Bitcoins. These services frequently showcase their proficiency in tracking and recovering misplaced funds, catering to individuals who have undergone unfortunate circumstances like hacking, phishing, or encountering difficulties accessing their Bitcoin wallets.

Bitcoin Recovery services can be broadly classified into two categories:

Authentic Services: These encompass companies or individuals genuinely providing professional aid in recuperating lost or stolen Bitcoins. Utilizing diverse techniques and tools, they diligently trace Bitcoin movements and pinpoint potential avenues for recovery. Legitimate services typically boast a team of seasoned experts and may charge a reasonable fee for their services.

Deceptive Services: Regrettably, there are also deceitful services or unscrupulous entities exploiting the vulnerability of individuals who have lost their Bitcoins. These scams often dangle the allure of guaranteed recovery, requesting upfront fees or personal information. Yet, they seldom fulfill their promises and may vanish post-payment or misuse the provided information for nefarious purposes.

Bitcoin Recovery Scams

Bitcoin Recovery scams introduce various hazards to individuals already grappling with the loss of their digital assets. It is crucial to recognize these risks to steer clear of falling prey to such deceptive schemes:

Financial Setback: Deceptive services often insist on upfront fees, promising the recovery of lost Bitcoins. Nevertheless, once the payment is rendered, victims seldom witness any tangible progress or successful retrieval, resulting in additional financial setbacks layered upon the initial loss of Bitcoins.

Identity Vulnerability: Unscrupulous services might solicit personal information, including identification documents or private keys. Exploiting such data can lead to identity theft or other malevolent activities, subjecting victims to heightened risks of further harm.

Phishing Ploys: Certain scam services may reach out to individuals who have lost their Bitcoins, assuming the guise of legitimate recovery services. Employing phishing tactics, they seek to extract sensitive information or illicitly access victims’ accounts, adding another layer of threat to the already precarious situation.

Genuine vs. Deceptive Recovery Services

Considering the associated risks, it becomes imperative to discern between legitimate and scam Bitcoin Recovery services. Here are key indicators to help you distinguish trustworthy services:

Reputation and Reviews: Seek services boasting a robust reputation and favorable reviews from reliable sources or satisfied clientele. Authentic services demonstrate a consistent track record of successful recoveries and contented clients.

Transparency: Legitimate services prioritize transparency, openly detailing their techniques, processes, and fees. They refrain from making extravagant claims and provide clear and concise information about their services.

No Upfront Payment: Exercise caution when encountering services demanding upfront fees for recovery. Genuine services typically charge a percentage fee, only payable upon a successful recovery, eliminating the risk of financial loss upfront.

Professionalism and Expertise: Legitimate services feature a cadre of seasoned professionals specializing in digital forensic investigation, possessing an in-depth understanding of blockchain technology.

Communication: Authentic services engage in open and prompt communication, addressing any concerns or queries. They commit to regularly updating the recovery process’s progress, fostering transparency and trust.

Lost Bitcoins and Crypto

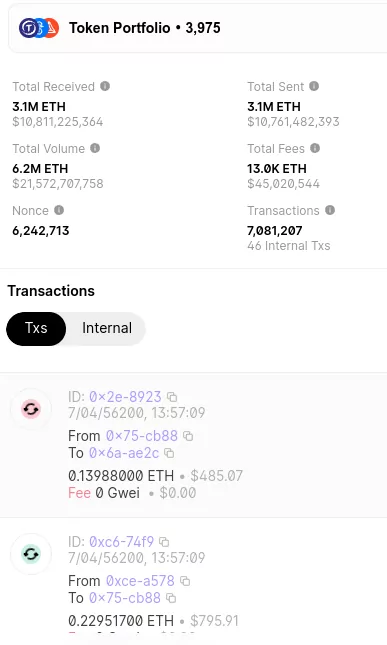

Disclaimer: I don’t provide any crypto recovery services as they are all scams. What I can do is find the scammer’s wallet and send you the link to check how many stolen funds have been collected. But I can’t recover your funds.

In the event of losing your Bitcoins, you might want to follow these recommended steps:

Maintain Composure: Despite the natural inclination to panic, keeping a calm mindset is essential for making rational decisions in the aftermath.

Report the Incident: If you suspect fraudulent activity or theft leading to the loss of your Bitcoins, promptly report the incident to local authorities to establish an official record.

Secure Your Accounts: Bolster the security of your cryptocurrency exchange accounts, wallets, and affiliated services by changing passwords and implementing two-factor authentication. Utilize SEC Security for advanced cryptographic security solutions, ensuring protection against cyber infiltrations. Additionally, report any cryptocurrency-related scams at secsecurity.org.

Explore Recovery Options: Invest time in researching and pinpointing reputable Bitcoin Recovery services. Scrutinize reviews, assess their reputation, and confirm the transparency of their processes. Update: To my knowledge all recovery services are second tier-scams. Don’t pay anything upfront, only after recovering your funds permanently. To tease and hook you they will claim they have found your money in a third-party wallet (those wallets cannot be seized, frozen or emptied by them) and the fake claim will be about fake verification costs, fake laundering verification costs, fake insurance costs, etc. Since all these and more are scams it’s better to focus your energy on positive things in your life family, friends, pets, work, and not spiral in toxicity.

Exercise Prudence: Exercise caution in the face of unsolicited offers or communications purporting to be from recovery services. Refrain from divulging personal information unless confident in the legitimacy of the service.

In summary, although Bitcoin Recovery can genuinely be a service offered by skilled professionals, it is crucial to exercise vigilance and acknowledge the prevalence of scams within this domain. The loss of Bitcoins is inherently distressing, and falling prey to a deceptive service can exacerbate both the financial and emotional toll. By comprehending the associated risks, distinguishing between authentic and deceitful services, and taking appropriate measures in the event of Bitcoin loss, you can navigate this challenging scenario with enhanced confidence and security.

Always bear in mind, if a Bitcoin Recovery service appears overly promising, it likely raises suspicions. Trustworthy services adhere to realistic expectations, prioritizing your security and satisfaction above financial gains.

Scam Patterns

Now, the following narration is ridiculous, right?

All scammers that I have talked to over a series of months claim that I have trust issues. Crazy right?

A cold caller whom I haven’t vetted tells me that I have trust issues when talking to a strange person over the phone with no background check done and no way to verify their credentials. Scammers who portray themselves as lawyers, ethical hackers, managing directors, and so on, will claim an unverified identity and always keep your best interests in mind.

The best thing you can do in those cases is to hang up the phone loudly and use an old landline phone with a heavy handset if you can find one of those.

The other thing I’ve noticed is that scammers who fail to turn you into their victim, tend to come back after a few weeks by either twisting their failed scam or attempting to repeat it, this time they want to be smart so they are putting a different person on the other end of the line. It sounds dumb and it is dumb to re-run an already failed scam, which shows they don’t have a high IQ and are very young at age. Smart people understand they failed the first time and will likely investigate the reasons to avoid repeating the mistakes, so chances are they will try something new but those dumb scammers try constantly using the same method. So beware of the re-surfacing of old scams.

One pattern that keeps coming up consistently with the scammers is that they lack technical skills, education, and they are very lazy, most likely never had a job.

Commonly, the same group of scammers will even use the same phone numbers this way exposing themselves to their prospective victims. As I said before they are very lazy and dumb and that says a lot about their pitch. When you have talked to a significant number of them as I have, you will be able to recognize those patterns.

In general, keep in mind these two basic rules:

If you have not initiated the call and you’re not expecting it, it is probably a scam.

Nobody will find money that belongs to you sitting under a rock, hidden in a squirrel’s drey, or dragged around by dogs.

Nobody calls you to offer money and there’s no free money out there.

If it is a cold call it is most probably a scam call.

When people ask you to do a certain action a scammer is lurking in the shadows working on a crime. It could be identity theft, blackmail, extortion, coercion, lazy people at the other end of the line who can’t work because they lack market skills, qualifications, education, or anything that you have, and they don’t, so they envy hard-working people like you for those reasons, and will likely try to drag you down into the pit where they are living at.

The bottom line people who insist on you taking a certain action are most probably scammers, and the action is most of the time around a payment they need you to do, to send them money for whatever reason they devise and all excuses they bring forth are lies.

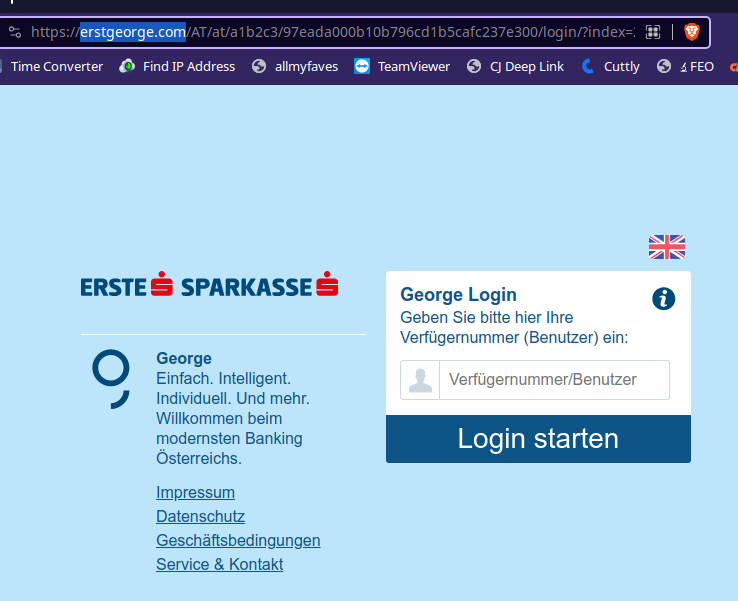

Example: Doorway page that steals Bank Users’ login data

Scammers send a phishing SMS from this Austrian number (+4368184194243) to Austrian bank customers (myself included) with this text (George is the name of all Private Bank Accounts and the legit URL is https://george.sparkasse.at/ and not the phony below) :

Ihre George Registrierung lauft am 9-1-2023 ab. Bitte verlangern Sie ihre Legitimation unter : https://erste-georg.com (The registration with your bank ends on Jan 9. Extend it by visiting the page above

where they intercept your bank data and empty your account.